Do you worry about money?

Is your bank account balance… out of balance?

Because she grew up poor and left home very young, Bonnie is very careful with money. When I met her she had managed her money better than I did. She had no debt and significant cash reserves. She was in a good position.

Though I had a business degree, I was a financial mess. I was heavily in debt from a poor investment decision – I thought that I was smarter than I really was, and I ignored good advice that was available to me.

The outcome was that I was often worried about meeting my obligations. This is not a good thing. You may know that the word “worry” comes from an old English word from West German origin, “wyrgan”, which means to strangle. The Anxiety Centre says that “having a choking feeling is a common symptom of chronic stress”.

Fortunately, Bonnie stuck with me and bit by bit we were able to create financial security with simple principles and good habits. Some I knew and didn’t apply. Some I discovered later. I have covered some of these simple wealth principles in other chapters. Let me add a few more and regroup them in one go-to chapter.

Thinking better about money

Personal finances were a bit of an abstract topic for me. I studied financial mathematics. I knew how the numbers worked. I just didn’t think well about money. The author Robert Kiyosaki really improved my thinking.

In his book Rich Dad, Poor Dad, Kiyosaki teaches that you need to choose your mentor based on their results instead of their status or of your relationships with them. My own dad was an awesome husband and dedicated father. He was a great role model for me. He provided for us a solid middle class life. To attain financial independence I needed to find different role models and mentors who excelled in finances. This equipped me to solve my financial problems once and for all.

Kiyosaki’s other book, Cashflow Quadrant opened my eyes to the type of income I needed to achieve the lifestyle I wanted. If you haven’t read the book, Kiyosaki breaks income sources into four quadrants. Two of them: employment and small business require your time to earn income. The other two, big business and investments can free your time. As I’m a time anxious person, the last two got my attention.

We were both employees and worked long hours. We were time poor. So, like millions of people who start a side gig, we sacrificed more time and invested it in building a business of our own. It started in the small business quadrant and grew to the point where our income requires a lot less of our time. We replace income that “rewarded” our presence, with income that rewards results.

Know your cash flow

You have incoming and outgoing cash in your life. You need to know how much is coming in and where it’s going. It’s embarrassing to have a business degree and to have neglected this basic life skill. I’m not alone. Many people with advanced degrees don’t know how to budget.

People who get in financial trouble often don’t have a budget, and many don’t know how they got their credit cards maxed out. It’s not for lack of tools or education. There’s a multitude of apps available. Consumer sites and banks offer free budget worksheets. Anyone can implement a budget.

The problem I had with many of these tools is that they reported the results at the end of a month, or that I failed to enter all the data, even when apps pulled data from my bank accounts and credit cards. I needed to know at the end of each day how I was doing.

I created a simple worksheet that mimics what many of our parents did when they lived in a cash economy. They split their cash in various envelopes. When the “groceries” envelope was empty, they didn’t spend more, they improvised with what was in the cupboard. We all ate a lot of mac and cheese. I needed to have the same attitude with digital money.

My worksheet is very simple.Each column totals a spending category. And at the top of each column is my budget amount. At the end of every day, I spend a couple of minutes entering our expenses, and the amount of the budget is automatically reduced. If the amount hits zero, it’s mac and cheese time.

We have no money problems today. We never spend all the money we earn. Yet I never want to quit the habit of tracking as it keeps me accountable and very importantly completely informs us about our finances.

To remain accountable, a few years ago, I started the habit of writing a brief monthly report that I send to Bonnie and to our mentors. I report on the KPIs (Key Performance Indicators) of our finances and our business. This accountability has been a game changer. I am writing this chapter at the beginning of November. I feel peaceful and focused because this monthly report was completed and sent on the first day of the month.

I strongly encourage you to implement these simple practices.

You can refer to our Principle “What’s Not Measured Cannot Improve.” for more wisdom on this matter.

The second best investment ever!

I know some financial gurus will disagree with me. They believe they have a foolproof plan for more profitable investments. Maybe. In my opinion peace of mind and good sleep are the best return on investments.

The first best investment is in growing yourself.

The second best investment is simply getting out of debt.

If you have consumer debt, you will repay it with after tax income. Consumer debt interest rates can be as high as 25% for credit cards. Let me use 10% for a simple example. You can plug in your own interest percentage and income tax rate. The formula is the same.

If your tax rate is 20%, only 80% of your income is available for debt payments. Take your interest rate and divide it by the percentage of your after tax income to get your real rate of return.

In this case 10% ÷ 80% = 12.5%.

Paying off this debt offers you an absolutely guaranteed rate of after tax return of 12.5%. This is an amazing rate for a completely risk free investment.

Mortgage: the Death Pledge

As French is my first language, I find it interesting that mortgage combines two words mort that means death, and gage, an old word that means pledge. Originally this meant a pledge that died when the debt was repaid or the borrower died.

Today a mortgage is the common form of loan that a consumer uses to buy a house. As the asset, the house and/or the land, will last a long time, the loan usually lasts 25 or 30 years.

Home ownership is one of the most common financial goals. Having a mortgage is seen as forcing you to save money as you gradually pay off the loan and one day you may be able to sell the house and use the cash for your retirement.

Governments put in place tax policies to facilitate this goal. In Canada the gain on the sale of a house is tax free. In the US, mortgage payments are tax deductible, but the gain on a sale of a house is taxable if not reinvested in a new home. There are other incentives, too many to discuss here.

Housing costs are the biggest item on most families’ budgets. Caution is required.

Should you rent or should you buy is a question many families struggle with. Most people need to rent for a period of time as they save for the downpayment on a house. Crunch your numbers carefully. If a car was worth $40,000, would you pay $80,000 for it? Having a 30 year mortgage at 6% means that you will pay for your house twice when you include the interest cost.

People can overcommit. 30% of a family’s income is considered prudent. However in some pricey cities, mortgage payments may use up more than 50% of a family’s income. If the income stops, and they can’t make their payments, financial losses can be huge (See leveraging below).

When the interest rates are low, it’s tempting to buy as much house as you can qualify for. The risk is that it stresses your budget because you don’t have enough income for your other expenses and you build up consumer debt to make up the shortfall.

Despite the tax incentives, I believe it makes sense to pay off a mortgage as fast as possible. Imagine how much easier a budget is when you no longer need to pay for your mortgage. Your budget surplus will soar and you can quickly build a significant cash pile.

Leveraging

Some people may advise you to borrow money to invest. This is called leverage. You use a financial lever to increase your return on investments. The idea is that you pay less in debt interest than you’ll receive from the investment you use the money for. For example, borrow at 5% and earn 8% for a gain of 3%. Sounds good? Maybe.

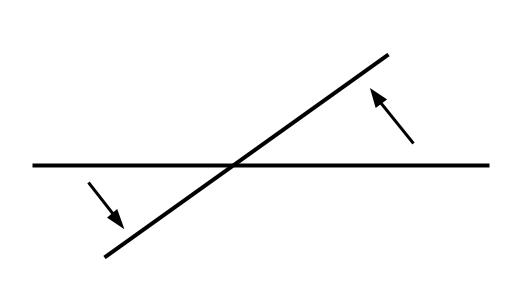

Make sure you understand that leveraging works both ways. You can win… and you can lose. Here is leverage in its simplest form. The horizontal line is your baseline return on investment. By borrowing money you can increase the rate of return – you tilt the line up.

This sounds good and is attractive, so people forget the other side of the line. If the investment doesn’t perform, you still have to pay for it. This causes you to lose money, leverage now works against you and reduces your baseline return on investment, and leveraging can make you lose money.

Build a cash pile

When you have paid off your debts, you will likely have a monthly surplus in your budget. It’ll be tempting to spend it. You’ll feel like you deserve some kind of reward. If you must, keep the reward very small as you want to get the real long term reward: financial peace of mind. (Read our chapter Delay Gratification).

The cash pile you build will give you the best emotional rewards.

- It’ll give you security as you’ll be equipped to handle the inevitable financial surprise like a car break down or a medical emergency.

- It’ll improve your self-image and confidence. The growing number in your bank accounts is a testimony to your discipline and accountability.

You’ll be the first one to benefit. Over the years, we’ve watched with pride how some people we mentor saved their first $1,000. And continuing positive change as they keep adding zeros to their balance. A $10,000 is the first major milestone. It proves to them they can reach $100,000 and beyond, as all it takes is repeating the process of budgeting and saving the surplus.

Getting out of trouble

You may think this all sounds good, however you may be in trouble with creditors and receiving calls from collectors. I understand. I worked briefly collecting commercial accounts. And I have received numerous calls from collectors when I was in trouble. I used to fear answering the phone.

Here’s what I learned to get out of trouble:

- Know how much trouble you’re in. Unfortunately, it’s typical for people in financial trouble to ignore reality. The sooner you know, the sooner you can start correcting the situation.

- Communicate: Collectors are people. Most of them genuinely want to help because they know that if they push too hard they may force the person into bankruptcy and collect nothing. They’re usually open to making payments arrangements.

- If you make payments arrangements, make sure the amount fits in your budget. Be accountable and don’t miss your commitments.

- If your situation is dire don’t hesitate to contact a credit counseling agency. They will provide great advice and they can shield you from further collection activities and manage your debt for you.

Always increase your income

Most financial problems come from giving yourself a one-two punch. You spend too much and you don’t make enough money. Respond with the opposite one-two punch. Contain your expenses and increase your income.

I learned to contain our expenses from Bonnie. Her Scottish genes have kept her frugal and prudent with money. A penny saved is a penny earned.

I completed her by seeking ways to increase our income. Like millions of other people, we started a side-gig. We took it seriously. The extra income helped pay off my debts. Eventually it made our employment income unnecessary.

As I get older, I see a lot of friends stuck in a fixed-income retirement. Inflation insidiously erodes their purchasing power, reduces their lifestyle and makes their future insecure. We’ve set up our business and our investments in such a way that we can forecast our income to keep increasing until we die.

That’s the kind of peace of mind we want for all of you with these simple wealth principles.

Open your notebook and explore these ideas:

- Are you happy with your finances? Why? Or Why not?

- What amount of money (cash pile) would create financial peace of mind for you?

- What can you change if you apply these simple principles?

From our bookshelf we recommend:

- Rich Dad. Poor Dad. by Robert Kiyosaki

- The Cashflow Quadrant, also by Robert Kiyosaki

- Who Took My Money? By Monique Gagné and our friend Cathie Orfali

- The Richest Man in Babylon by George Samuel Clason